Good Tips For Picking RSI Divergence Trading

Wiki Article

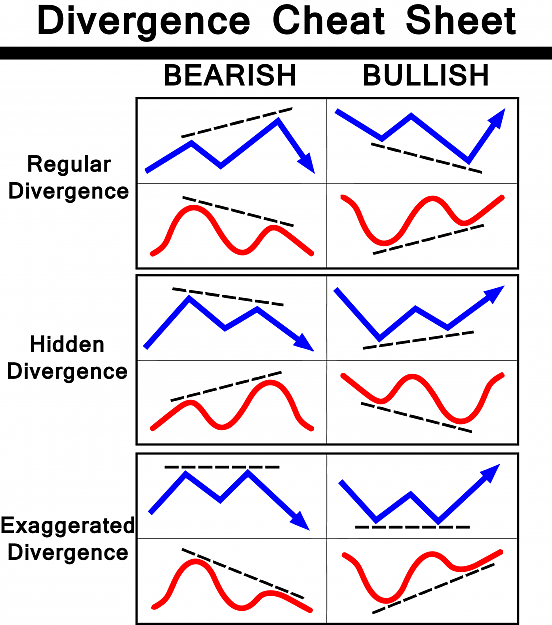

Ok, Let's start with the most obvious query and explore what is RSI Divergence is and what trading signals we can derive from it.|Let's begin by asking the obvious question. Let's explore what RSI Divergence means and what trading indicators it might offer.|Let's start with the most obvious question. We'll explore the meaning of RSI Divergence actually is and what insights traders can get from it.|Okay, let's begin by asking the obvious question. Let's look at the meaning behind RSI Divergence really is and what trading signals we can take away from it.|Let's start with the most obvious question. Now, let's examine what RSI Divergence looks like and the trading signals that can be drawn from it.} If the price action on your chart and the RSI signal are not in alignment, a divergence could take place. Which mean, in a Downtrend market Price will make a lower low, but the RSI indicator makes higher lows. A divergence happens when the indicator isn't in accordance with price movement. If this occurs, it is important to be aware of the market. The chart clearly shows bullish RSI divigence and bearish RSI divigence. This is why the price action reversed immediately following every RSI divergence signal. Let's move on to the fun discussion. See the best RSI divergence for more advice including backtesting platform, trading platform cryptocurrency, backtesting tool, trading divergences, forex tester, automated trading bot, automated forex trading, forex backtesting software, cryptocurrency trading, crypto trading backtester and more.

How Do You Analyze The Rsi Divergence

We utilize the RSI indicator as a way to recognize trends that have reversals. However, it is crucial to recognize the correct trend reversal.

How To Identify Rsi Divergence When Trading Forex

Both Price Action (RSI indicator) and Price Action (Price Action) did the same thing at the start of the trend. They both made higher highs. This indicates that the trend is strong. When the trend is over, trend, prices reach higher highs while the RSI indicator forms lower highs. This means that there are some things worth monitoring in this chart. This is the reason we have to be attentive to the market. The indicator and the price movement are not on the same page which could signal an RSI divergence. In this instance this case, the RSI divigence signals the bearish trend. Look at this chart to see what transpired following the RSI divergence. You can see that the RSI divergence is highly accurate when it comes to finding trends that are reversing. Now, the question is how to catch the trend reversal. Well, Let's talk about four trade entry strategies that offer higher-risk entry signals when combined with RSI divergence. Follow the best crypto trading backtesting for blog advice including position sizing calculator, stop loss, best crypto trading platform, automated cryptocurrency trading, forex trading, crypto trading backtester, backtesting strategies, forex backtesting software free, automated trading, divergence trading and more.

Tip #1 – Combining RSI Divergence & the Triangle Pattern

Triangle chart pattern is available in two variations, One is Ascending triangle pattern which is can be used as a reversal design in the downtrend. The descending triangle pattern functions as an uptrend market pattern that reverses. Now, Have a look at the descending triangle pattern in the forex chart below. Like the previous example above it started out in an uptrend before the price fell. RSI also indicates divergence. These signals reveal the flaws in the current uptrend. Now we see that the speed of the ongoing upward trend has diminished and the price ended with a downward triangular pattern. This is a confirmation of that the opposite is true. It's now time to take the short trade. We followed the same techniques for breakouts as in the previous example. Let's now move on to the third technique for trading entry. We'll try to combine trend structure with RSI divergence. Let's explore how we can trade RSI divergence when the structure of the trend is changing. View the best divergence trading forex for website examples including online trading platform, backtesting tool, cryptocurrency trading bot, software for automated trading, backtesting strategies, backtesting trading strategies, stop loss, online trading platform, automated cryptocurrency trading, best forex trading platform and more.

Tip #2 – Combining RSI Divergence and the Head and Shoulders Pattern

RSI diversification can be a valuable tool for forex traders to identify market reverses. So what if we combined RSI divergence with other reversal factors like the Head and shoulders pattern? We can boost the likelihood of our trade, That is great, right? Let's examine how to timing trades with RSI divergence in conjunction with the head-shoulders pattern. Related: How to trade Head and Shoulders in Forex - A Reversal Trading strategy. Before committing to trades it is essential to have an appropriate market. Since we're trying to find the possibility of a trend reversal, it is preferential to have a market that is trending. Check out the chart below. View the top online trading platform for website recommendations including automated trading, backtesting tool, forex backtesting software, forex backtesting, trading platform, position sizing calculator, trading platform, forex backtesting software, automated cryptocurrency trading, backtesting tool and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

The trend is our friend, isn't it? So long as the market is trending, it is important to trade in the direction of the trend. This is what professionals teach. But the trend isn't lasting forever. At some point , it's going to reverse, isn't it? We will learn how to identify reversals fast by observing the trend structure and the RSI divergence. As we know, upward trends are creating higher highs while downtrends are forming lower lows. Check out that chart. Now if you take a look to the left of the chart, you will see that it is an downtrend that has a pattern of lows and lower highs. Next, take a look at "Red Line" which shows the RSI divergence. The RSI creates higher lows while price action causes them. What do these numbers tell us? Despite the market creating low RSI which means that the current downtrend is losing its momentum. Have a look at the most popular cryptocurrency trading for site tips including crypto trading backtester, trading platform cryptocurrency, trading divergences, automated cryptocurrency trading, automated forex trading, crypto trading backtesting, forex trading, cryptocurrency trading, crypto backtesting, online trading platform and more.

Tip #4 – Combining Rsi Divergence Along With The Double Top & Double Bottom

Double top, also known as double bottom, is a reverse pattern formed after an extended movement or following a trend. In the double top, the first top is formed when the price is at a certain level that can't be broken. Once that level has been reached, the price will dip a little, and then bounce back to test the previous level. If the price moves back to this level, there is a DOUBLE TOP. The double top is below. In the double top above, you can see that two tops were formed following a powerful move. It is evident that the second one has not been able to break the top of the previous. This is a strong indicator that a reversal could take place because it informs the buyers that they're struggling to continue going higher. The same set of principles is applied for the double bottom, however in a different way. Here, we use the breakout trading strategy. In this instance, we sell the trade when the price breaks below the trigger line. The price fell below the trigger line, and we made a sale within a day. QUICK PROFIT. The same trading techniques are employed for double bottom too. Below is a graph that explains the best way to trade RSI diversgence when using the double top.

It is not the ideal trading strategy. There isn't a thing as a perfect trading strategy, and all the trading strategies suffer from losses and they must be dealt with. Although we make consistent profits through this strategy for trading however, we are able to implement a rigorous risk management system and a method to limit our losses. This allows us to cut down on drawdowns, and open the door to huge upside potential.