Recommended Tips For Deciding On Forex Trading Bots

Wiki Article

What Are The Main Factors That Influence Rsi Divergence

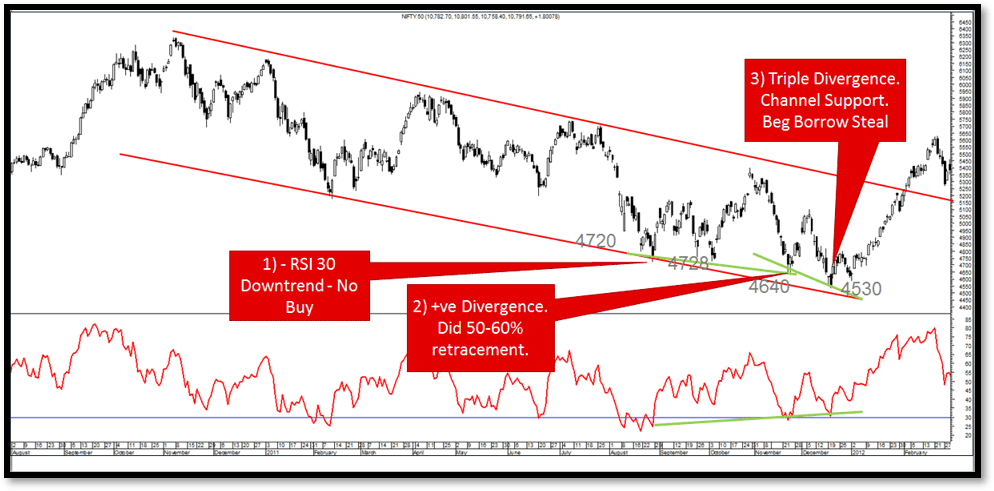

Definition: RSI Divergence refers to a technical analysis tool that compares the price movements against its relative strength index (RSI). There are two types: regular divergence and hidden.

Signal Positive RSI signal is considered a bullish sign, while a negative RSI deviation is believed to be bearish.

Trend Reversal - RSI divergence may indicate an upcoming trend reversal.

Confirmation RSI diversification can be utilized along with other analysis methods to confirm.

Timeframe: RSI diversification can be examined using various time frames to get different perspectives.

Overbought/Oversold RSI values above 70 indicate overbought. Values below 30 indicate oversold.

Interpretation: To understand RSI divergence in a correct manner, you need to take into consideration other fundamental and technical factors. View the top trading with divergence for website recommendations including software for automated trading, automated cryptocurrency trading, automated forex trading, crypto trading backtester, position sizing calculator, bot for crypto trading, cryptocurrency trading bot, backtesting tool, best forex trading platform, RSI divergence and more.

What Is The Difference Between Regular Divergence And Concealed Divergence

Regular Divergence: A price swing that causes an asset to make a higher high/lower low and the RSI to create a lower low/higher high is referred to as regular divergence. It could be an indication of a trend reversal , but it is important that you take into consideration other technical and fundamental factors. Hidden Divergence: when the price of an asset makes a lower high/lower low when the RSI makes an upper or lower low. Even though it's a weaker signal that regular divergence, it could still be a sign of a potential trend reversal.

To be aware of the technical aspects:

Trend lines, support/resistance indicators and trend lines

Volume levels

Moving averages

Other indicators and oscillators

You must consider the following essential points:

Releases of economic data

Specific information specific to your business

Sentiment indicators and market sentiment

Global events and their impact on the market

Before you make investments based solely on RSI divergence signals , it is important to take into consideration both technical and fundamental factors. Have a look at the top rated forex backtesting for site tips including forex backtester, forex backtesting software free, trading with divergence, cryptocurrency trading, backtesting, trading platform crypto, position sizing calculator, backtesting platform, automated cryptocurrency trading, forex backtest software and more.

What Are Back-Testing Trading Strategies For Trading Crypto

Backtesting crypto trading strategies involves simulating the use of a trading strategy using historical data in order to determine its profitability. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy Define the strategy for trading being tested with regard to rules for entry and exit as well as position sizing and the rules for managing risk.

Simulation: You can use software to model the way in which the trading strategy will be implemented using historical data. This allows for you to observe how your strategy will perform in the future.

Metrics. Make use of metrics such as profitability and Sharpe ratio to assess the strategy's effectiveness.

Optimization: Change the strategy's parameters and run the simulation once more to optimize the strategy’s performance.

Validation: To ensure the method is dependable and avoid overfitting, verify the effectiveness of the strategy on data that is not part of the sample.

Be aware that the past performance of a company is not an indication of future results and results from backtesting should not be taken as a guarantee of future gains. It is equally important to think about the effect of fluctuations in the market, transaction costs, and other factors that affect real-world trading when using the strategy in live trading. See the top rated trading platforms for site recommendations including trading divergences, crypto trading bot, automated trading, cryptocurrency trading bot, forex backtesting software, trading platform cryptocurrency, RSI divergence cheat sheet, stop loss, trading platforms, cryptocurrency trading and more.

What Do You Need To Do To Test The Forex Backtesting Program Trading With Divergence

When looking into backtesting software for forex designed to trade with RSI diversification, there are a few important factors to consider The accuracy of the data: Make sure the software has easy access to accurate historical data on the currency pairs that are traded.

Flexibility: The software should allow customizing and testing various RSI trading strategies.

Metrics: The software must offer a range metrics that can be used to assess the performance and the profitability of RSI divergence strategies.

Speed: The software should be efficient and fast. It should allow quick backtesting for multiple strategies.

The user-friendliness. The software must be easy to understand, even for those who have no technical background.

Cost: Think about the price of the software and whether it fits in your budget.

Support: The software should come with good support for customers, including tutorials and technical support.

Integration: The software needs to be able to integrate with other tools for trading, such as charting software or trading platforms.

Before purchasing an annual subscription, it's essential that you test the software first. Check out the top rated RSI divergence cheat sheet for more tips including automated trading bot, trading platform, crypto trading backtesting, crypto trading bot, crypto trading, trading with divergence, backtester, backtesting trading strategies, cryptocurrency trading, software for automated trading and more.

What Are The Functions Of The Automated Trading Software's Cryptocurrency Trading Bots Function?

The cryptocurrency trading robots operate as an automated trading system , following predefined rules and performing trades on behalf of the user. This is how they work. Trading Strategy: The user creates a trading strategy that includes the rules for entry and exit, size of the position and risk management rules and risk management.

Integration: The bot for trading integrates with a cryptocurrency exchange through APIs, which allows it to connect to real-time market data and make trades.

Algorithm is a method that the bot uses to analyze market data in order make decisions based mostly on trading strategies.

Execution: The robot executes trades automatically based on the trading plan without any manual intervention.

Monitoring: The robot continuously monitors the market and makes adjustments to the trading strategy as required.

A robot that trades in cryptocurrency could help you execute repetitive or complex strategies. However, it's important to realize that automated trading comes with the associated risks, which include the potential for software mistakes, security vulnerabilities, and losing control over the trading decisions. Before you can begin trading on the market, you must be sure to thoroughly test and analyze your trading robot.